Open Source Monetary Policy

Money creation’s progress from local communities to global protocols

How do you make money? This is one of the most interesting questions I have spent time thinking about. How does a new kind of money come into being? Who decides how many $, €, ¥ & £ should exist? When they create those monies, who do they give them to and why? The rabbit hole of monetary policy runs very deep.

I am new to this field so please correct me if I make any mistakes in my assessments.

There are so many great histories of money. My favourite so far is Ascent of Money, by Niall Ferguson. He does a great job of walking someone through the phase shifts in money creation. We moved from local scratches on rock all the way to global blockchains that can be beamed across the planet in seconds.

What I want to focus on is this latest shift: central banking to decentral banking

An excellent 8-minute primer on all the concepts can be found here:

Central Banking

As a global society, we spend an incredible amount of time thinking about who will lead our country and very little time thinking about who will lead our money.

Central banks around the world are built up and maintained in lots of different ways. What seems to be a common theme among a lot of them is that they are mix of appointees and internally elected individuals. There is very little insight into the selection process.

If you were to get all of the world’s most powerful central bankers together in one room it would probably be fewer than 1,000 people.

Think about this for a second: <1,000 people control the monetary pulse of the planet.

That is absolutely insane to me.

Euro

I love this photo of “Madame” Lagarde and her colleagues at the European Central Bank. Have you ever seen more white and grey hair surrounding a table set in such opulent circumstances?

When these old men decide to print more Euros, who do you think they think about? Do they represent the young, the diverse, or the poor? Do those people even cross their mind?

Aged academics with lots of letters are responsible for the future generations’ circumstances.

That feels wrong to me.

Bank for International Settlements

Have you ever heard of Agustín Carstens? He is the General Manager of the Bank for International Settlements (BIS). He is the personification of everything I despise about central banking. If you watch this video, you can see him clearly stating that central banks want to track everything you spend in real-time. Today, governments in sensible countries need a warrant to get access to that data. If this big bad boss of banking gets his way, that will go away when they start minting Central Bank Digital Currencies (CBDCs).

This guy doesn’t even bother to hide his organisation’s intentions. He wants full financial surveillance to be the new normal.

That disgusts me.

Federal Reserve

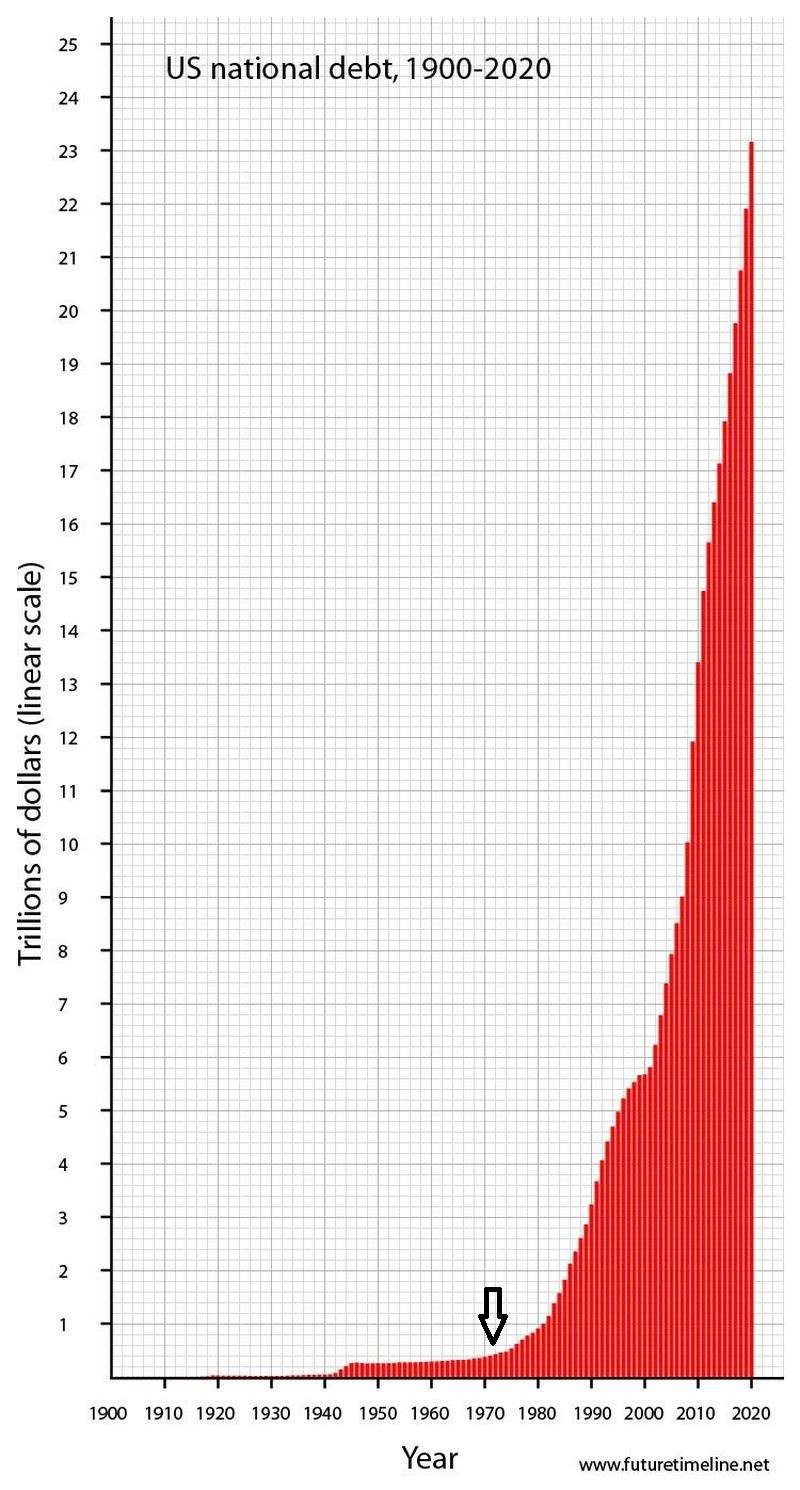

The most successful central bank on the planet is the Federal Reserve. The expansion of the dollar from a single country’s currency to the global settlement layer of the planet is extraordinary.

The power that the US wields on the global stage is staggering. When the Fed creates more dollars, the world must bend the knee. This a hilarious tongue-in-cheek meme video about their recent performance:

Do you know who runs the Federal Reserve? I didn’t until recently. These 7 people wield a level of power that I have only recently started to appreciate.

Do you think the world’s global settlement currency should be determined by so few people?

That feels a bit too centralised for me.

21 million Bitcoin

Bitcoin totally changed the game. It came out swinging for the financial system with an innovative new protocol and a very simplistic monetary policy: Let’s print 21 million Bitcoin for 144 years and see what happens.

This is amazing for memes. Everyone can wrap their head around the 21M meme. It is is simple but it is also far too simplistic.

If we could solve all the world’s monetary issues by counting to 21 million for a hundred years it would be great. Unfortunately, I think the solutions are going to be much more complex than that.

Do you think the first ever monetary policy to be put into a blockchain is going to be the best possible thing that mankind can come up with?

I do not think so.

Deflationary Ether

The monetary policy of Ethereum is still up in the air. Unlike Bitcoin, it was not set in stone at the beginning. Instead, it was left open to debate. Over time, that policy has matured and strengthened with the progress of the protocol. This interview with Justin Drake is one of the best pieces of content on Ethereum of all time. Watch it:

Justin makes the case that Bitcoin is going to be inflationary for decades. While Ethereum could actually become deflationary within a decade or sooner. If that happens, the amount of circulating supply of Ether will decrease each year.

Would you prefer a store of value that was expansionary or contractionary?

I love the idea of a digital and deflating store of value.

Maker

The most successful project in the Decentralised Finance (DeFi) space is a project called Maker DAO. They take in volatile collateral such as Ether and produce a stablecoin known Dai. The system has gone through two major revisions and is now storing over $7 billion of collateral.

What I find so magical about Maker is that anyone can contribute to the system or get involved in the governance process around its monetary policy. Each week a lot of people gather together to debate the interest rates and risks of the system.

I spent a huge amount of time working on interfaces for the protocol.

The people who built this system spent an incredible amount of time and energy ensuring it was safe for everyone. All of their work is open source.

Do you think a more a decentralised approach to monetary policy is worth trying?

I think is one of the most exciting ideas ever.

Fei

Over the last 4 months, I have been helping the team at Fei Labs prepare the launch of their new protocol. The Genesis Group has just gone live and anyone can participate.

It closes in 2 days: https://fei.money

The Fei team are taking a new approach to creating a decentralised stablecoin for the DeFi space. It aims to be more scalable and capital-efficient. It is testing many new mechanisms which are extremely experimental.

Do you think it is cool that a bunch of people can experiment with new crypto-economics in a few months?

I do.

What’s next?

I like to think of Ethereum as an open source and open state system for economic engineering. Anyone can publish anything and interact with any kind of code.

We are going to see all kinds of open source monetary policies play out over the coming decade. Today, most stablecoins target the US dollar and effectively create a synthetic asset.

In the near future, we are going to see much more interesting forms of stability. RAI, FLOAT and OHM are covered in this excellent piece by Ryan Watkins who writes for Messari.

Are you excited?

I am 🌲

a brilliant read Ric, happy to be on this list!

While I completely agree with your opposition to a global monetary system controlled a few unelected policymakers, I think that case is weakened, not strengthened, by childishly making fun of people for being old or overweight.